christmas quickpage freebie

sex games meet and fuck cheerleader

puffco promo code reddit

sheetz hiring near me

quick chating wife fuck lover

asian males least atteactive on dating

representative samples

human resources manager resume samples

you could win $5,000 in the plan for college sweepstakes

contests and sweepstakes definition

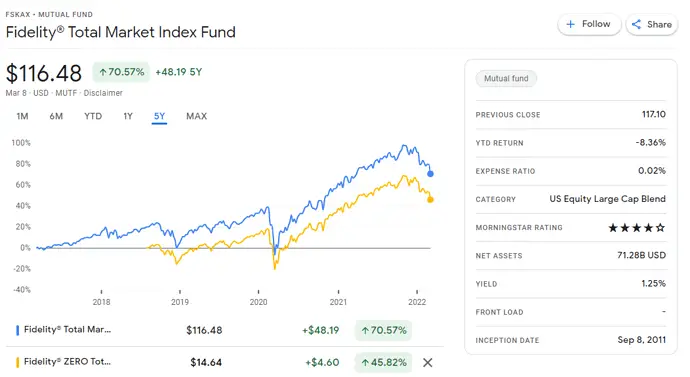

When it comes to investing in mutual funds, its important to do your research and compare different options before making a decision. Two popular funds that investors often consider are FZROX and FSKAX. Both funds have their own unique features and benefits, and understanding the differences between them can help you make an informed investment choice. FZROX, also known as the Fidelity ZERO Total Market Index Fund, is a popular choice among investors who prefer low-cost index funds. One of the main advantages of FZROX is its expense ratio, which is currently at 0%. This means that investors do not have to pay any management fees or other expenses associated with the fund. This can be a significant advantage for long-term investors, as lower expenses can potentially result in higher returns over time. FSKAX, on the other hand, is the Fidelity Total Market Index Fund. This fund also tracks the performance of the total U.S. stock market, but it has a slightly higher expense ratio compared to FZROX, currently at 0.015%. While this may seem like a small difference, it can add up over time, especially for investors who plan to hold the fund for an extended period. One important factor to consider when comparing FZROX and FSKAX is their investment minimums. FZROX has no minimum investment requirement, making it accessible to investors with any budget. On the other hand, FSKAX has a minimum initial investment requirement of $2,500. This means that investors who are just starting out or have a smaller amount to invest may find FZROX more appealing. Another key difference between the two funds is their performance history. FZROX was launched more recently in 2018, while FSKAX has a longer track record dating back to 1997. This longer history allows investors to analyze the funds performance over different market cycles and make more informed decisions. However, its important to note that past performance is not indicative of future results, and investors should always consider their own risk tolerance and investment goals when making decisions. Both FZROX and FSKAX are passively managed funds, meaning they aim to replicate the performance of a specific index rather than actively selecting individual stocks. FZROX tracks the performance of the Fidelity U.S. Total Investable Market Index, while FSKAX tracks the performance of the Dow Jones U.S. Total Stock Market Index. Both indices include a broad range of U.S. stocks, providing investors with exposure to the overall market. One advantage of passive investing is that it typically results in lower expenses compared to actively managed funds. By eliminating the need for extensive research and stock selection, index funds like FZROX and FSKAX can keep costs low and potentially offer higher returns to investors. This makes them popular choices for investors who prefer a more hands-off approach to investing. When it comes to investing in mutual funds, its always important to consider your own investment goals, risk tolerance, and time horizon. Both FZROX and FSKAX offer investors the opportunity to gain exposure to the U.S. stock market with low expenses. However, the choice between the two ultimately depends on your personal preferences and financial situation. If you are just starting out or have a smaller amount to invest, FZROX may be a good option due to its lack of minimum investment requirement. On the other hand, if you have a larger amount to invest and prefer a fund with a longer track record, FSKAX may be a better fit. Its always a good idea to consult with a financial advisor or do thorough research before making any investment decisions. In conclusion, comparing FZROX and FSKAX can help investors make an informed decision when it comes to investing in mutual funds. Both funds offer exposure to the U.S. stock market with low expenses, but they have differences in expense ratios, investment minimums, and performance history. By considering your own investment goals and financial situation, you can determine which fund is the right fit for you.

FSKAX vs fzrox vs fskax reddit. FZROX : r/Fidelity - Reddit. Outofstockgrocery FSKAX vs. FZROX Fidelity offers two total market index funds fzrox vs fskax reddit. FSKAX with fees of 0.015% and FZROX with zero fees. My question is since both are total market index funds and perform based on the market what is the point of investing in the one that charges fees versus the zero fund? Am I missing something here?. For those with Fidelity - FZROX or FSKAX and why? - Reddit. by MP1182 For those with Fidelity - FZROX or FSKAX and why? I have my company offered 401k diversified in Vanguard fundschristmas quickpage freebie

. However, my IRA is with Fidelity. I have shares that I purchased years ago that Im still holding (AAPL, MSFT, V). I have money in different funds as well, but I do have money split in both FZROX and FSKAX.. FZROX vs FSKAX : r/fidelityinvestments - Redditsex games meet and fuck cheerleader

. FZROX vs FSKAX What are the differences ? 4 4 4 comments Best Add a Comment FidelityMarian Community Care Representative • 6 mo fzrox vs fskax reddit. ago Thank you for connecting with Fidelity Investments on Reddit, u/Podricc! You are able to compare two mutual funds, by using our "Compare" feature on the mutual fund research page:. FZROX vs FSKAX : r/Fidelity - Reddit. 10 17 comments Best Add a Comment fareastbeast_02 • 2 yr fzrox vs fskax reddit. ago Cant go wrong with either unknown-human-69 • 2 yrpuffco promo code reddit

. ago Cant go wrong with either [deleted] • 2 yr fzrox vs fskax reddit. ago I believe , and someone correct me if Im wrong FZROX is $0.00 fees FSKAX has low fee but dividends beyercj • 2 yr. ago

sheetz hiring near me

. 20 comments Add a Comment Cruian • 3 yr fzrox vs fskax reddit

quick chating wife fuck lover

. However on a tax deferred IRA, none of that matters so Plus, inside Fidelitys IRA, you can always convert your FZROX to FSKAX in a day. You arent really missing out on anything.. FSKAX vs. FZROX: Which Fidelity Fund Is the Best?. 13 Comments By Jamie Johnson, WCI Contributor FSKAX and FZROX are two popular funds offered by Fidelity. Both are low-cost mutual funds that invest in large-cap stocks. Both, by virtue of being index funds, are likely a good (and cheap!) place to invest your money. But there are some differences.. Best Total Stock Market Index Funds Of 2023 - Forbes. Fidelity Total Market Index Fund (FSKAX) Expense Ratio 0.015% Dividend Yield 1.53% 10-Year Avg. Annual Return 11.47% Why We Picked It Schwab Total Stock Market Index Fund (SWTSX) Expense Ratio.. FZROX vs VTSAX : r/personalfinance - Reddit fzrox vs fskax reddit. FZROX vs VTSAX. FZROX is Fidelity, VTSAX is Vanguard. Disclosure: I own VTSAX shares. FZROX has a 0% expense ratio and is a "Total Market Index Fund" with no transaction fee that was created earlier this month. Im sure were all familiar with VTSAX but its also a "Total Stock Market Index Fund" with up to this point the lowest expense ratio .. [FZROX vs FSKAX] - Bogleheads.orgasian males least atteactive on dating

. The price per share is irrelevant. Fidelity Total Market Index Fund (FSKAX) ER 0.015%, and Fidelity ZERO Total Market Index Fund (FZROX) ER 0.00% are both good funds. In my opinion they are nearly equivalent, one is not a better option than the other, and the track records have been about the same